- Get link

- X

- Other Apps

Posted by

rupigyan

- Get link

- X

- Other Apps

Aaj ke time me har koi apne future ko secure banana chahta hai. Lekin savings karna aur usse sahi jagah invest karna ek challenge ban gaya hai. Aise me SIP (Systematic Investment Plan) ek smart aur easy option hai. Lekin kai log abhi bhi confuse hote hain ki SIP kya hota hai, SIP kaise kaam karta hai, aur isme paisa kaise badhta hai?

Is detailed guide me hum SIP

investment ke har aspect ko simple Hinglish me samjhayenge. Agar aap ek

beginner hain ya apne future ke liye smartly paisa invest karna chahte hain,

toh yeh article aapke liye perfect hai.

Table of Contents

- SIP Kya Hota Hai?

- SIP Investment Kaise Kaam Karta Hai?

- SIP Aur Mutual Fund Me Kya Rishta Hai?

- SIP Ke Types

- SIP Me Invest Karne Ke Fayde

- SIP Vs Lumpsum Investment

- SIP Calculator Kya Hota Hai?

- SIP Start Kaise Karein?

- SIP Investment Ke Liye Best Mutual Funds

- SIP Me Tax Kaise Lagta Hai?

- SIP Me Kya Risk Hota Hai?

- SIP Ke Baare Me Myths

- SIP Me Kitna Paisa Invest Karein?

- SIP Ke Liye Best Platform

- Conclusion

1.

SIP Kya Hota Hai?

SIP ka full form hai – Systematic

Investment Plan.

Yeh ek aisa tarika hai jisme aap har month ya week ek fixed amount invest karte

hain, mostly mutual fund me.

Jaise aapne decide kiya ki har mahine

₹1000 invest karenge, toh yeh paisa automatically aapke bank se deduct hoke

mutual fund me chala jaata hai.

Yeh investment regular intervals me

hota hai – monthly, quarterly ya weekly.

2.

SIP Investment Kaise Kaam Karta Hai?

SIP ek automated aur disciplined

investment process hai. Jab aap SIP start karte hain:

- Har month ek fixed amount aapke bank account se deduct

hota hai.

- Yeh amount kisi mutual fund scheme me invest hota hai.

- Har baar jab paisa invest hota hai, us din ke NAV (Net

Asset Value) ke hisab se aapko mutual fund ke units milte hain.

- Time ke saath-saath aapke units badhte hain aur

compounding ke effect se aapka paisa grow karta hai.

Example:

Agar aap ₹2000/month invest karte hain aur 12% annual return milta hai, toh 20

saal baad approx. ₹20 lakh ka corpus ban sakta hai.

3. SIP Aur Mutual Fund Me Kya Rishta Hai?

SIP khud me ek investment method

hai, lekin yeh mutual fund ke through hota hai.

SIP se aap equity, debt, hybrid

ya index fund me invest kar sakte hain.

Yani SIP ek mode hai aur mutual

fund ek vehicle hai jisme aapka paisa lagta hai.

4.

SIP Ke Types

- Regular SIP:

Har month same amount invest hota hai.

- Top-Up SIP:

Aap gradually SIP amount badha sakte hain.

- Flexible SIP:

Aap SIP amount ko kam ya zyada kar sakte hain.

- Perpetual SIP:

Aise SIP jiska koi end date nahi hota.

- Trigger SIP:

Yeh SIP market conditions ya events ke hisaab se trigger hoti hai.

5.

SIP Me Invest Karne Ke Fayde

1.

Discipline Banata Hai:

Har month invest karne ki aadat ban

jaati hai.

2.

Rupee Cost Averaging:

Market kabhi upar-kabhi neeche hota

hai, is wajah se aapko long term me average price milta hai.

3.

Power of Compounding:

Jitna lamba samay invest karenge,

utna paisa compounded interest ke through grow karega.

4.

Chhoti Amount Se Shuruaat:

SIP ₹100 se bhi start kiya ja sakta

hai.

5.

Emotional Bias Nahi Aata:

Regular investment se market fear ya

greed aapke decision ko affect nahi karte.

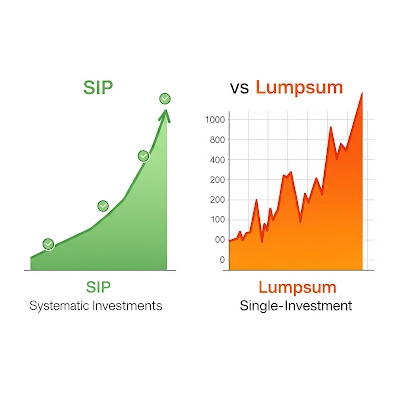

6. SIP Vs Lumpsum Investment

| Feature | SIP | Lumpsum |

|---|---|---|

| Investment Pattern | Regular (Monthly) | Ek hi baar mein |

| Market Timing Risk | Low | High |

| Discipline | High | Low |

| Suitable For | Salaried Person | People with Bulk Money |

7.

SIP Calculator Kya Hota Hai?

SIP Calculator ek online tool hota hai jisme aap:

- Monthly investment amount

- Investment duration

- Expected return

... enter karke pata kar sakte hain

ki aapka future corpus kitna banega.

Example:

₹5000/month for 20 years at 12% return → approx. ₹50 lakh ka fund.

8.

SIP Start Kaise Karein?

- KYC Process Complete karein. (Aadhar + PAN mandatory)

- Kisi trusted platform ya mutual fund website pe jaake

SIP select karein.

- Monthly amount, date aur scheme decide karein.

- Auto-debit facility set karein.

- SIP chalu ho jaayega!

9. SIP Investment Ke Liye Best Mutual Funds (2025)

Disclaimer: Mutual Fund investments

are subject to market risk. Research is important.

Top-performing funds for SIP in 2025

(as per past data):

- Axis Bluechip Fund

- Parag Parikh Flexi Cap Fund

- Quant Small Cap Fund

- ICICI Prudential Technology Fund

- HDFC Index Fund – Sensex Plan

10.

SIP Me Tax Kaise Lagta Hai?

- Equity Fund SIP:

Agar aapke gains ₹1 lakh se upar jaate hain aur holding 1 saal se kam ki

hai, toh Short Term Capital Gains Tax lagta hai (15%). 1 saal se

zyada rakhne par LTCG 10% hai.

- Debt Fund SIP:

Holding period pe depend karta hai. Short-term par normal income tax slab,

long-term par 20% after indexation.

11.

SIP Me Kya Risk Hota Hai?

- Market down hone par temporary loss ho sakta hai.

- Galat fund choose karne par return kam ho sakta hai.

- Short term me volatility hoti hai, lekin long term me

benefit hota hai.

12.

SIP Ke Baare Me Common Myths

|

13.

SIP Me Kitna Paisa Invest Karein?

Ye totally aapke:

- Financial goal

- Monthly income

- Risk appetite

... pe depend karta hai.

SIP

Goal Planning:

|

14.

SIP Ke Liye Best Platform (2025)

- Zerodha Coin

- Groww

- Kuvera

- Paytm Money

- ET Money

- Directly AMC Websites (e.g., HDFC MF, Axis MF)

15.

Conclusion: Kya Aapko SIP Karni Chahiye?

Agar aap financially secure

future, retirement planning, child education ya wealth creation ke liye

invest karna chahte hain, toh SIP best option hai.

SIP se:

- Aap chhoti amount se bhi shuruaat kar sakte hain

- Market timing ka tension nahi hota

- Long-term me bada corpus bana sakte hain

🔑 FAQs (Frequently Asked Questions)

Q1: SIP minimum kitne se shuru hota

hai?

Ans: ₹100/month se bhi SIP shuru ho sakta hai.

Q2: Kya SIP se loss bhi ho sakta

hai?

Ans: Haan, market-based investment hai. Lekin long-term me chances kam hote

hain.

Q3: SIP aur FD me kya difference

hai?

Ans: SIP market linked hoti hai, jabki FD fixed return deti hai.

Q4: SIP band karne ka charge lagta

hai kya?

Ans: Nahi, aap kisi bhi waqt SIP band kar sakte hain.

Agar aapko yeh article informative

laga ho, toh apne doston ke saath zarur share karein. Agar koi question ho toh

neeche comment karein – hum reply zarur denge!

Keywords used for SEO:

SIP kya hota hai, SIP kaise kaam karta hai, Mutual fund SIP in Hindi, SIP

benefits, SIP calculator, SIP vs FD, SIP returns, SIP investment guide 2025.

Best SIP Plans 2025

Mutual Fund SIP

SIP Benefits

SIP Calculator

SIP Investment in Hindi

SIP Kaise Kaam Karta Hai

SIP Kya Hai

SIP vs Lumpsum

Systematic Investment Plan

- Get link

- X

- Other Apps

Namaste! Mera naam Jaydip Solanki hai. Main pichhle 12 saalon se accounting aur finance ke kshetra mein kaam kar raha hoon. Is blog Rupigyan.online ke madhyam se main apna personal aur professional anubhav aap sab ke saath share karta hoon, jisme aapko milenge: Finance aur personal budgeting tips Stock market aur investments ki jankari Loans, credit card aur insurance se judi useful baatein Indian taxation aur finance laws ka simplified gyaan Mera lakshya hai ki main har vyakti tak sahi aur saral bhasha mein financial knowledge pahuchaaun, taaki wo apne arthik nirnay khud le sakein – bina kisi confusion ke. Rupigyan – Rupi ka Gyan, Hindi me Asaan.

Comments